Case Study: Wintrust Bank

This page is still under construction - please check out the Ragas Live Case Study

Background

This was a project created on spec for the Wintrust Bank who had expressed a desire to find innovative ways to help parents and children create good financial habits.

Our team was Daniel Moon, Christeen Seed, Madelen Soto and myself.

We began our process with the users themselves and interviewed 4 parents and 3 children (aged 11-15)

After synthesizing the data through affinity mapping we found a few common patterns.

Allowance is the main way parents

give their children money

The most important financial habit that parents hope their children develop is saving

Parents want their children

to learn more about investing.

Parents are open to incentivizing their children to increase their financial education

Children prefer to keep track of

their money online and prefer mobile

Both parents and children found the idea of shared saving goals appealing.

In order to empathize more closely with our users we created two personas which were closely based on our interview data:

and his father, John:

As the children in our interviews preferred mobile over desktop we analyzed what is currently on the app market, looking at Wintrust’s direct competitors and comparative businesses. Our goal was to find out what these apps may offer users like John and Kyle who want to develop better financial habits.

Amongst the 11 applications we looked it, we found a few features that could be helpful to Kyle and John in their goals.

Armed with personas, interview data and market research our team began to define the problem:

Parents need to educate their children on financial responsibility; however, Wintrust financial company currently does not offer the tools to facilitate this.

We came up with tons of questions but pared them back to this:

How might we automate the process of parents giving their kids money?

How might we make saving and other good financial habits fun and easy for children to learn?

How might parents work together with their children to develop good savings habits?

After a lot of wild divergent thinking we settled on a path forward:

We will create a simple digital eco-system for parents to transfer money to their children for allowances, set shared savings goals, and reward good financial habits like studying and investing.

In order to pull this off we would need to have different interfaces for both children and parents. Here are the key features:

Account monitoring: Both Kyle and John can easily see their balances and recent history for checking, savings, and investment accounts.

Shared savings goals: Users expressed a strong interest in collaborating on savings goals, so we incorporated a tool where kids can save up money for their next adventure or purchase and have the accountability of a parent to monitor it. The parent also has the option to contribute to the goal.

Earn/transfer money: On Kyle's side he can earn by doing chores or by completing sessions in the Money 101 section of the app. On John's side - he can see when Kyle has completed chores and transfer his allowance. He can also transfer for other reasons such as shared savings goals or gifts.

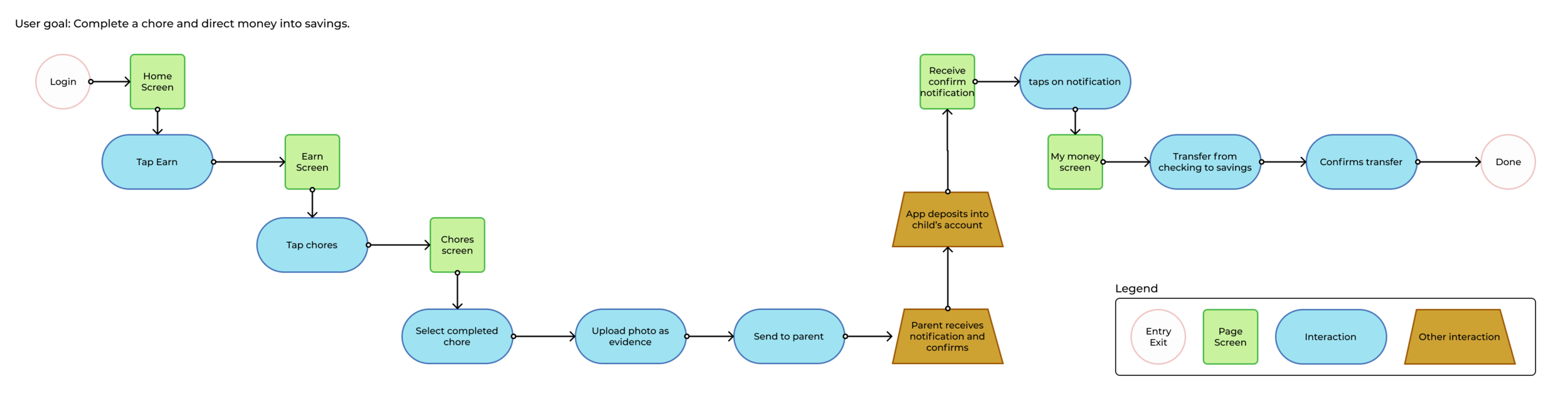

This was a lot of functionality to wrap our heads around so we developed some user flows and created a storyboard to think through how this would all work.

It still seemed a bit abstract so we thought through how it would all work as a story. At this point Kyle and John’s journey really meant something to us.

Wintrust Bank

The Problem:

Wintrust bank is looking for ways for clients to help their children develop good financial habits

The Solution:

Design in-app ecosystem where parents and children can set shared savings goals, manage transfers and allowances and reward children for furthering their financial education.

The Results:

From our initial prototype we improved from a task completion rate of 77% to 100%. SUS score improvement from 2.9 to 4.2. .